Dual model tracks

Multiple core model lines run in parallel, including neuroevolution-trained and backpropagation-trained variants, all validated under the same out-of-sample protocol.

Independent quantitative trading firm

ENZO-TS is a research-driven team operating a proprietary trading stack for crypto markets. Model families are neural-network centered, with strict out-of-sample validation across multiple market phases.

Execution and monitoring run on a custom C++ runtime built for control and operational reliability. Capital preservation is the mandate: deployment and portfolio weighting are intentionally selective, prioritizing drawdown control over constant exposure.

Approach

ENZO-TS operates across 10+ major markets with a layered process: per-market model selection at the signal layer, then portfolio-level capital allocation at the live trading layer.

Multiple core model lines run in parallel, including neuroevolution-trained and backpropagation-trained variants, all validated under the same out-of-sample protocol.

The signal layer evaluates both model lines for each market and routes to the better suited one for current conditions using live and walk-forward diagnostics.

Walk-forward tests, live telemetry, and drawdown diagnostics feed daily ranking decisions for model and market activation, with weak pairs de-emphasized or sidelined.

Technology

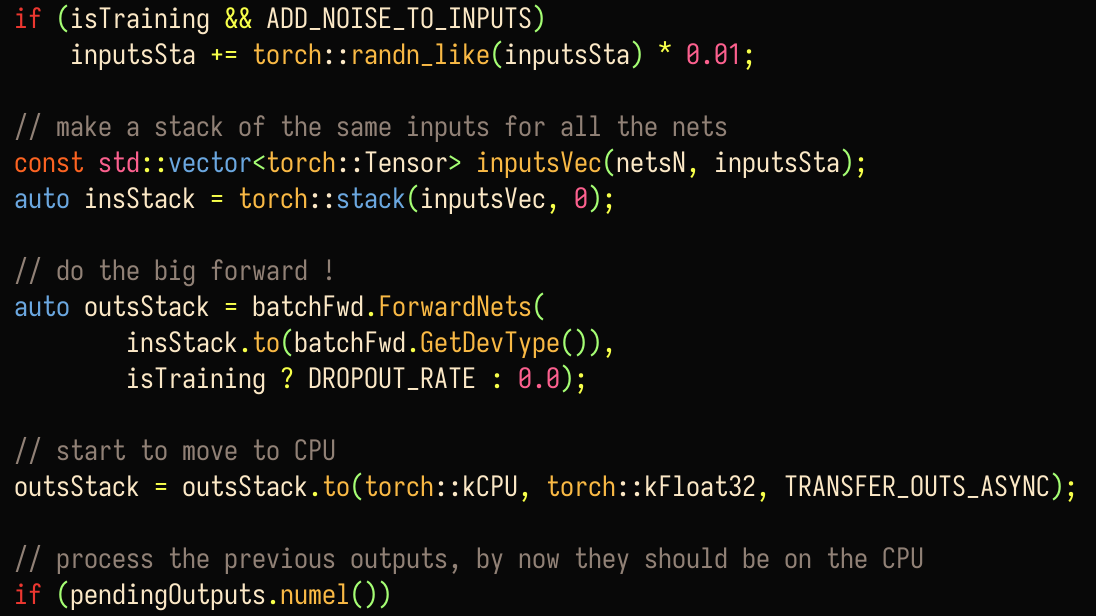

Core training, backtesting, and execution components are written in modern C++ for deterministic behavior and high-throughput multi-core research workloads.

The system is designed for modular research and customization, enabling controlled rollout of strategy and risk logic updates without rebuilding process fundamentals.

Live signal inspection, portfolio-level analytics, and market diagnostics are integrated in the same runtime environment used for operational decisions.

About

ENZO-TS operates as part of NEWTYPE K.K. in Japan, with research, engineering, and operations coordinated under the same organization.

Visit newtypekk.comRisk Framework

Risk mitigation is layered across model, market, and portfolio decisions, similar to a Swiss-cheese-style defense where each layer targets different failure modes.

Position sizing and per-trade risk are bounded by predefined limits and enforced stop logic.

Live capital is assigned through a risk-budget process combining model confidence, realized volatility, and cross-market correlation, with concentration caps.

Underperforming markets are de-emphasized or disabled, while stronger markets receive incremental budget within portfolio-level limits.

Public Track Record

Loading 90-day snapshot...

Open full details on BybitTrend data is currently unavailable.

Source: Bybit public copy-trading endpoints, cached as a static 90-day snapshot. Values are shown for transparency and may lag exchange UI updates.

Private Contact

ENZO-TS operates an internal trading system and considers a limited number of partner or firm-level discussions.

Private Inquiry